Introduction

Speculative bubbles are of crucial importance in the field of economics and finance, as they represent phenomena capable of profoundly influencing markets, investors and entire economies. Understanding the dynamics of speculative bubbles is essential to prevent financial crises and mitigate their devastating effects.

The 2008 financial crisis is an emblematic example of how speculative bubbles can have global repercussions. Studying bubbles helps develop strategies crucial for economic stability and investor protection. In addition, analyzing these phenomena offers valuable lessons for the future, helping to build financial systems that are more resilient and less susceptible to crises of this magnitude.

What a Speculative Bubble is?

A speculative bubble occurs when the prices of an asset grow rapidly and disproportionately to their real value. This phenomenon is supported by demand and speculation, rather than solid economic fundamentals. Investors buy these assets in the hope of reselling them at higher prices. However, when you realize that prices are unsustainable, the market collapses.

In simple words, a speculative bubble happens when the value of something increases very quickly. People buy an asset expecting to be able to resell it at a higher price. When these expectations turn out to be unfounded, the price plummets and many investors suffer losses.

Signs of a Speculative Bubble

The signs and indicators characteristic of a speculative bubble include rapid and sustained growth in asset prices, often without a corresponding increase in their intrinsic value. A first indicator is the disconnect between market prices and economic fundamentals, such as profits or dividends in the case of shares, or renters’ income for real estate.

Another sign is excessive media coverage and public interest in the asset in question, with news and discussions exalting its earning potential. In addition, there is a growing presence of new investors, often inexperienced, attracted by the possibility of easy earnings.

The increase in the volume of transactions is also an indicator, as it suggests intense trading activity. Finally, there is an expansion of credit, with financial institutions offering favorable conditions for buying speculative assets, thus increasing overall leverage in the market. These signals, taken together, may suggest the formation of a speculative bubble.

How do Investors Behave?

During a speculative bubble, investors demonstrate irrational optimism and collective euphoria, as they allow themselves to be carried away by the desire for quick and easy gains, often neglecting to conduct rational analysis of the asset’s fundamentals. Widespread compliance occurs, with many investors blindly following other people’s decisions without carefully assessing the risks. In addition, there is an increase in greed, with investors trying to maximize their profits by investing ever larger sums of money. This behavior further fuels asset price growth, creating a vicious circle of speculation.

Another important aspect is the fear of missing out on earning opportunities, known as FOMO (Fear Of Missing Out). Investors are driven by fear of being excluded from the extraordinary profits that others seem to make. This fear can lead investors to enter the market even when the signs of a speculative bubble are evident, thus helping to further fuel asset price growth. However, at the first sign of a possible market crash, euphoria quickly turns into panic, with investors desperately trying to liquidate their positions before it’s too late, thus contributing to the collapse of the bubble.

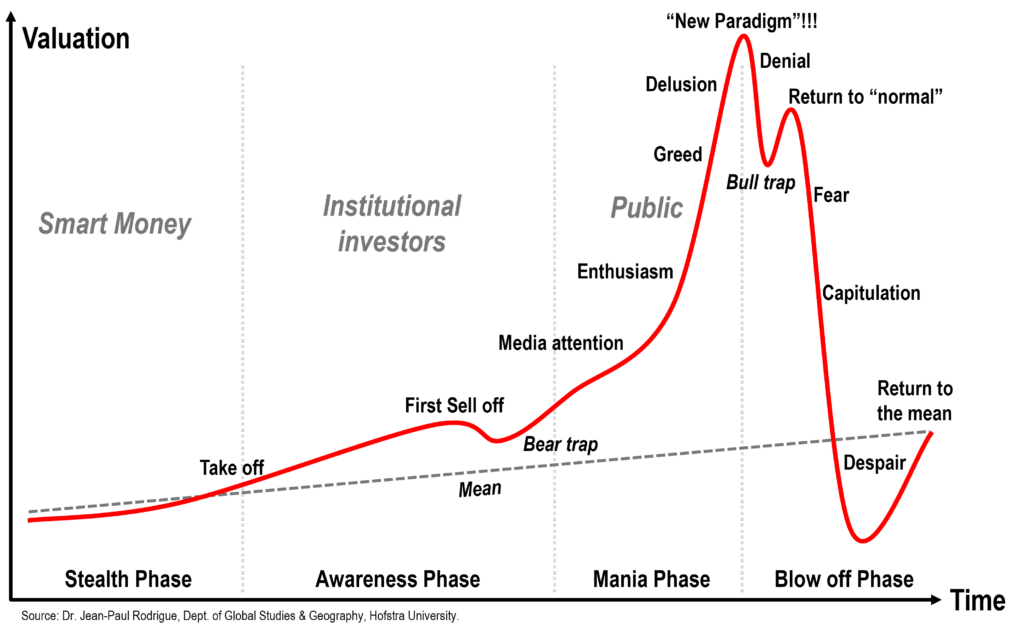

The Stages of a Speculative Bubble

Speculative bubbles go through several distinctive stages during their life cycle. In the first phase, asset prices initially grow, often fueled by innovations or events that arouse interest in the market. At this stage, initial investors are often innovators or institutional investors who recognize the earning potential of the asset.

Subsequently, the growth phase accelerates, with a significant increase in asset prices attracting more and more investors, including those who join the trend for fear of losing earning opportunities (FOMO).

The phase of maximum optimism is the culmination of the bubble, characterized by collective euphoria and a climate of irrational confidence in the continuous rise in prices. At this stage, investors feel invincible and tend to ignore the warning signs of an impending bubble.

However, the phase of maximum optimism is followed by the panic phase, in which investors begin to sell their assets en masse in an attempt to limit losses. This leads to a rapid collapse in asset prices and the end of the speculative bubble, followed by a period of correction and market adjustment.

But What are the Causes?

Speculative bubbles are the result of a complex combination of economic and psychological factors. From an economic point of view, a key factor is the abundance of liquidity in the financial system, often fueled by accommodating monetary policies or easy access to credit. When money is plentiful and inexpensive, investors tend to take more risks and seek higher returns, often investing in assets with high speculative potential. In addition, technological and financial innovation can create new investment opportunities that, if not properly regulated, can fuel speculative bubbles.

Psychologically, emotions such as greed and fear often fuel speculative bubbles. Investors can irrationally confide in the market and experience collective euphoria, driven by the presence of other investors making high profits. This euphoria can lead to flock behavior, with investors blindly following the decisions of others without carefully assessing the risks. On the other hand, the fear of losing earning opportunities can push investors into the market even when signs of a speculative bubble are evident. This behavior contributes to further fueling asset price growth. In summary, speculative bubbles are the result of a combination of economic and psychological factors. These factors fuel a cycle of irrational optimism, speculation, and ultimately market collapse.

What About the Consequences?

One of the most obvious impacts is the destabilization of financial markets. The collapse in asset prices can lead to huge financial losses for investors, financial institutions, and pension funds. This situation can trigger a chain reaction. There is an increase in the risk of default for financial institutions and a decrease in investor confidence. Consequently, this can lead to a further sale of assets and a further fall in prices.

Speculative bubbles can also have an impact on the real economy, affecting the spending of consumers and entrepreneurs. When a market collapse occurs, the wealth of households and businesses decreases, reducing their propensity to spend and invest. This can lead to a contraction in economic activity, with a decrease in production, employment and incomes. In addition, speculative bubbles can affect the financial stability and health of the entire economic system, with the risk of banking crises and a reduction in credit available to businesses and consumers.

Finally, speculative bubbles can have a lasting impact on the image and credibility of financial markets and regulatory institutions. The bankruptcies and failures caused by speculative bubbles can undermine investors’ confidence in the market and its regulatory mechanisms. This can lead to greater mistrust and uncertainty in the global financial system. Additionally, these failures can raise questions about the role and effectiveness of financial regulation and oversight policies. There is a need for reforms and changes to prevent future episodes of speculation and financial instability.

Knowing the Subject

Understanding the phenomenon of speculative bubbles and the importance of financial education is essential for everyone, whether you are a consumer or an investor. Knowing the dynamics of speculative bubbles helps you protect your savings and make more informed investment decisions. Being aware of the signals of a speculative bubble enables you to avoid being dragged into irrational behavior and to protect your financial assets from huge losses.

In addition, financial education helps you understand the core principles of investment, adopt a long-term financial strategy, and assess risks and opportunities in a rational way avoiding cognitive biases. Investing time and energy in deepening financial knowledge can make the difference between financial success and failure, ensuring greater economic security and stability in the long term.

In conclusion, understanding speculative bubbles and investing in financial education are crucial steps in protecting your assets and planning for a secure financial future.