Introduction

The 2008 Subprime Mortgage Crisis stands out as a major financial downturn in recent times. Its repercussions spread globally, creating widespread economic chaos and prompting governments to step in and stabilize markets.

This confluence of subprime lending practices and the collapse of Lehman Brothers laid bare vulnerabilities within the financial sector, prompting serious questions about regulatory oversight, risk management strategies, and corporate governance structures. As the crisis unfolded, it underscored the interconnectedness of global financial markets and highlighted the need for more robust safeguards to prevent similar catastrophes in the future.

The Context of the Crisis

The subprime mortgage crisis had deep roots in the economic and financial context of the time. During the previous years, in the United States, there had been a rapid expansion of the real estate sector, with a significant increase in home prices. This has led many people to invest in the real estate market, creating a speculative bubble that led to property prices going up.

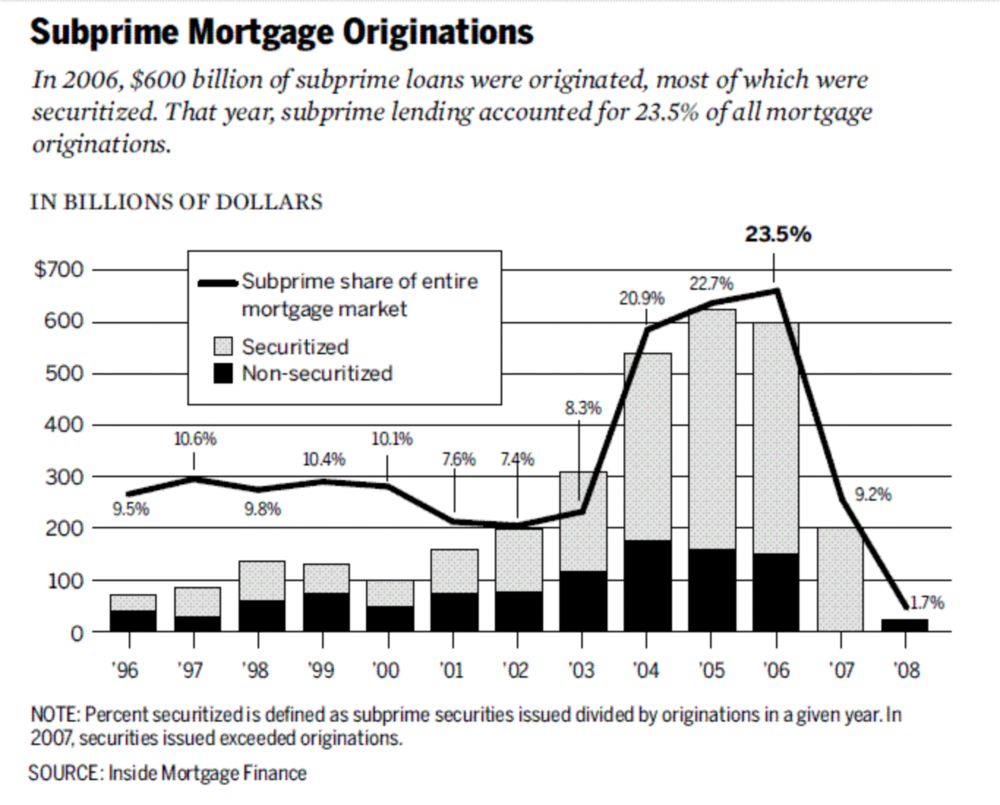

A key element was the indiscriminate release of mortgage loans to people with low or uncertain incomes, as shown in the film ‘The Big Short‘. Different financial institutions, driven by the prospect of high profits, have granted mortgages to people who could not have afforded them under normal circumstances.

Meanwhile, banks and other financial institutions had begun to package and sell these loans in the form of financial securities, with the hope of making profits from mortgage remittances. This has led to a rapid spread of subprime loans in the global financial system.

But What a Subprime Mortgage is?

But before we get to the heart of the action, let’s explain what a Subprime Loan is. This is a type of mortgage loan granted to individuals with a low credit score (a score usually between 300 and 850 that in the United States reflects the risk that a person may not repay their debts) or at high financial risk. These loans often have higher interest rates and less favorable terms than traditional loans. Buyers of subprime loans may have a history of non-payments or an unstable income.

People accepted these loans because they wanted to buy a home, often hoping that the value of the properties would continue to rise. In addition, many were attracted by the low initial rates offered, without considering future rate increases. This practice contributed to the bursting of the real estate bubble and the subsequent subprime mortgage crisis and the collapse of Lehman Brothers of 2008.

The Beginning of the Subprime Mortgage Crisis

The first signs of the onset of the subprime lending crisis emerged as early as 2007, when an increasing number of borrowers began to miss installment payments. Financial institutions, which had invested heavily in securities backed by these loans, started to make significant losses. The rating agencies, initially optimistic, have suddenly downgraded these securities, highlighting their riskiness. This has led to a loss of confidence in the financial market, resulting in a credit crunch.

The first obvious signs were the bankruptcy of some financial companies specializing in subprime mortgages, such as New Century Financial Corporation, and the need for financial bailouts for others. The crisis intensified when large banks started declaring large losses, triggering panic among investors. Liquidity has become scarce and many institutions have started to drastically reduce lending, further worsening the economic situation.

Warning signs were ignored or minimized by many, but in hindsight, these events were clear indicators of imminent collapse.

The Lehman Brothers Failure

Subprime mortgage defaults were a crucial element of the 2008 financial crisis. As subprime borrowers began to miss payments, the value of the securities guaranteed by these mortgages collapsed. These securities, known as mortgage-backed securities (MBS), were widely held by banks and other financial institutions. The deterioration of MBS led to massive losses in banks’ balance sheets, triggering a chain reaction of devaluations and downgrades.

The deterioration in mortgage-backed securities has had a devastating impact on many large financial institutions. Bear Stearns, one of the leading investment banks, was among the first to collapse, rescued in extremis by JPMorgan Chase with the support of the federal government. However, the most glaring failure was that of Lehman Brothers in September 2008.

With massive exposure to subprime mortgages and mortgage-backed securities, Lehman Brothers failed to find a buyer or a government bailout, declaring bankruptcy. This event sparked panic in global financial markets, leading to further failures and emergency bailouts, including those of AIG, Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation). These events highlighted the fragility of the financial system and the need for structural reform to avoid future crises.

The Propagation of the Subprime Crisis

The spread of the subprime mortgage crisis had a domino effect on global financial markets, rapidly spreading beyond the borders of the United States. As subprime borrowers began to miss payments, the value of the securities guaranteed by these mortgages collapsed, causing huge losses for the financial institutions that held them. These losses have led to a crisis of confidence in the financial system. Banks, aware of their exposures and potential future losses, have started to drastically reduce lending, causing a credit crunch.

This crisis of confidence quickly spread to global markets. International financial institutions, also exposed to US mortgage-backed securities, suffered significant losses. Panic-stricken investors began withdrawing their capital from the stock and bond markets, causing stock exchanges around the world to crash. Liquidity has become scarce, and many companies have struggled to finance their daily operations.

A Global Recession

The crisis led to a global recession through a number of interconnected mechanisms. The tightening of credit has significantly slowed economic activity, resulting in a decline in investment and industrial production.

This caused a decrease in aggregate demand, leading to further reductions in consumer spending and international trade. Companies, hit by shrinking demand, have reduced production and jobs, fueling a downward cycle of unemployment and loss of income. The combined effect of these factors has fuelled a negative spiral, plunging many world economies into deep recession.

Crisis in the Labor Market

But it doesn’t stop here! The subprime mortgage crisis has caused widespread unemployment and a crisis in the labor market, with millions of people losing their jobs due to reduced investment and cuts in the company budget.

The credit crunch has made it more difficult for companies to obtain finance to expand or maintain their operations, leading to redundancies and company closures. Rising unemployment has also fuelled the economic downturn, as consumers have reduced spending, contributing to a vicious circle of recession.

State Responses to the Subprime Crisis

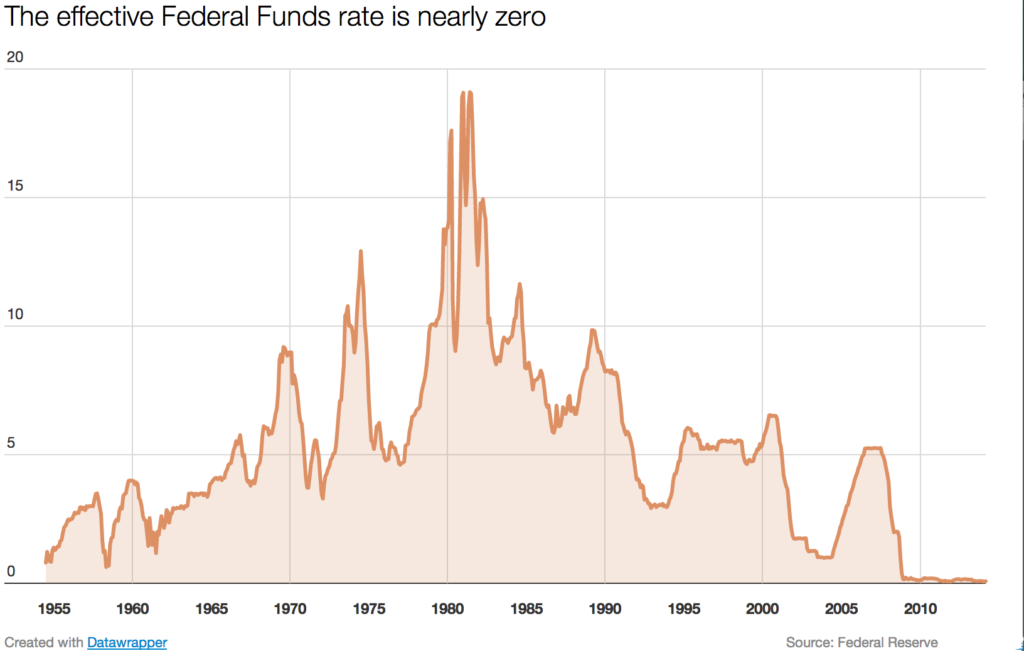

To address the 2008 financial crisis, governments around the world have adopted extraordinary monetary and fiscal policies. Central banks, including the US Federal Reserve and the European Central Bank (BCE), have drastically reduced interest rates and implemented quantitative easing policies to increase liquidity in the financial system. These measures encouraged investment and stimulated spending, seeking to mitigate the effects of the credit crunch and support the recession economy.

In addition, governments have launched rescue packages for ailing financial institutions and have injected liquidity to strengthen the banking system. The United States government implemented the Troubled Asset Relief Program (TARP) to buy toxic assets from banks and provide them with fresh capital. In Europe too, rescue programmes have been set up for banks in difficulty.

Fiscal policies have seen the adoption of economic stimulus plans to support domestic demand and boost growth. These plans included tax cuts, public spending increases and investment incentives. The objective was to provide a safety net for families affected by the crisis and to encourage economic recovery.

Implementing these financial maneuvers came at a cost. Central banks’ actions, such as lowering interest rates and injecting liquidity, increased the risk of inflation. Government interventions, like bailout packages and stimulus programs, led to ballooning budget deficits and public debt. These measures also sparked debates over moral hazard, as some argued that they incentivized risky behavior by financial institutions. Furthermore, the long-term consequences of such interventions, including potential distortions in asset prices and market dynamics, remain subjects of ongoing scrutiny and analysis.

What do we Learn?

This crisis triggered a broad reflection on how to prevent future financial crises. Among the measures taken was further regulatory reform of the financial sector, with the aim of increasing transparency, strengthening supervision and mitigating systemic risk. Central banks have adopted more conservative policies in regulating credit and liquidity, overseeing excessive leverage and risky lending practices.

In addition, measures have been introduced to improve risk management by financial institutions and to increase the resilience of the financial system as a whole. The importance of diversification of investments and continuous supervision of financial markets has been underlined, together with the need for a more informed and informed financial culture among investors and the general public.

Conclusion

The subprime mortgage crisis remains a crucial benchmark for understanding the cyclical nature of the economy and the risks associated with financial deregulation and the irresponsible practice of lending.

It is crucial that governments, financial institutions and individuals learn from this crisis by adopting responsible and sustainable financial policies and practices. Understanding the complexity of this crisis better prepares us for future challenges and building a more resilient and stable financial system.